Catching up with Schuyler Bull '10, G'10: A checklist of success that never ends

April 30, 2021 · 2021

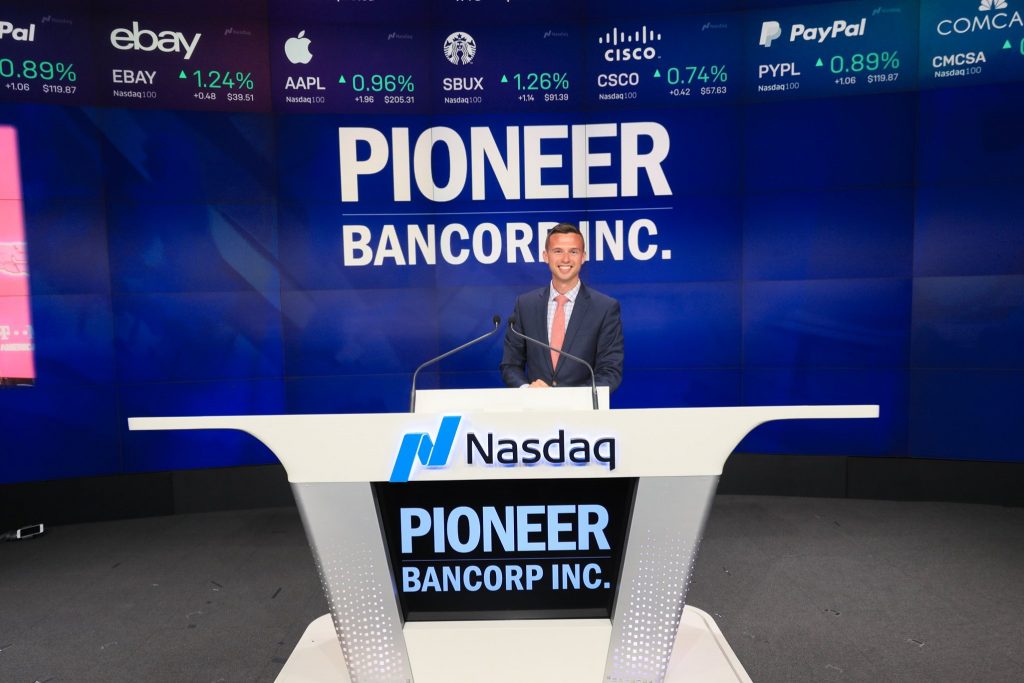

As a corporate executive in financial services, as well as a startup entrepreneur in a tough market, Schuyler Bull ’10, G’10 has dealt with myriad business challenges in just over a decade since graduating. Managing a huge marketing and branding effort as vice president of marketing for Pioneer Bancorp? Check. Being at the opening bell the day his organization went public? Check. Pulling his small Albany-based business, Fort Orange General Store, through the COVID-19 pandemic – and ending up in the black? Check. Keep smiling through it all? Check.

What do you do in a typical day?

One of the many things I love about my job is that no two days are the same!

Generally speaking, I oversee Pioneer’s branding and marketing, which means my team and I are responsible for delivering all advertising, graphic design, communications, public relations, and so forth. This past year, my team was also responsible for developing and launching Pioneer’s new brand strategy, which included a reorganization of our brand and various business units, as well as all-new visuals and messaging across our footprint.

A typical day consists largely of project management – ensuring our in-house team is communicating with our agency partners and various vendors to deliver campaigns and assessing the effectiveness of those campaigns through data analysis, as well as assisting our business units with whatever needs they may have, be it visual merchandising, updating the website or social media, creating speaking points, or drafting press releases, hosting video or photo shoots, or planning events.

It’s a job that certainly keeps me on my toes at all times!

How did you find your career path?

I graduated in 2010 as the effects of the Great Recession were still affecting the job market. To gain some “real world” experience, I took an unpaid internship at a local PR firm for the summer following commencement, which turned into a job offer by September.

I was fortunate to have been provided the opportunity, and it opened many doors for me professionally.

Through professional contacts, I’ve been able to grow into marketing roles for the tourism/hospitality sector, business development, and now the financial services industry – while also using the managerial skills I acquired along the way to open and run a small business on the side.

How has your Saint Rose experience helped you in your career?

Saint Rose was the start of it all; I didn’t know much about the business world before arriving as a first-year student, but I made a point to take advantage of every opportunity that came my way so that I was not only learning in the classroom but applying my education to real-life scenarios, such as joining the Student Association, being an RA, or volunteering in the Albany community. Each one of those experiences taught me something new that I’ve carried with me into my career.

I truly believe that the extracurriculars are just as important as the in-classroom experience, and Saint Rose provided a perfect balance of the two.

What are three things you’ve learned from working in a large organization?

Stay curious. My organization, Pioneer Bank, delivers banking, insurance, wealth management, and employee benefits solutions to our customers, along with running a charitable foundation and being publicly listed on the NASDAQ. There is more to each of these worlds than I can ever know, so I constantly have to be asking the right questions in order to deliver the best results.

Relationships are vital. Be it with coworkers, vendors, agency partners, or the community, it’s important to have a strong network willing to support you and guide you along the way.

Quality over quantity. Due to staffing, time, or budgetary constraints, I’ve learned that you can’t do it all – no matter how badly you want to – so it’s important to stay organized, focus on priorities, and execute them exceptionally.

What are three things you’ve learned from starting up your own business?

Know your numbers. As a small business owner, it’s imperative that you understand how each and every dollar is being allocated and how to maximize its impact. You have to understand how to use credit appropriately and to your advantage and to control costs that can quickly spiral out of control.

Adapt or die. If there’s anything the past year has taught us, it’s not so much that you have to be prepared for everything, but that you’re willing to be flexible and try new things. Our business strategy had to shift instantly; there was no time to overthink it, we just had to get it done. Thankfully, we finished the year up 30% over the previous and finally turned a profit since opening three years ago.

Hire good people and treat them like gold. My success as a small business owner is completely dependent upon my staff’s ability to be motivated to do their job well. Hiring people who are passionate about your mission and who are determined to succeed is imperative, so I make sure to do everything I can to reward their efforts on a regular basis.

(Bonus) Just. Keep. Going. There will be days it seems nothing is going as it should, and you question why you went into this to begin with. But, with the support of a great team and a can-do attitude, it all turns out OK. It’s not easy, but it’s worth it.

By Irene Kim